Timeseries modelling

Table of Contents

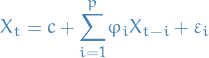

Autoregressive (AR)

Idea

Output variable depends linearly on its own previous values and on a stochastic term (accounting for the variance in the data).

Model

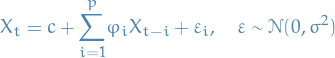

AR(p) refers to autoregressive model of order p, and is written

1

1

where

are parameters

are parameters is a constant

is a constant is white noise (Gaussian rv.), i.e.

is white noise (Gaussian rv.), i.e.

The unknowns are:

- constant

- the weights / dependence

of the previous observations

of the previous observations - the variance of the white noise

Estimating the parameters

- Ordinary Least Squares (OLS)

- Method of moments (through Yule-Walker equations)

There is a direct correspondance between the parameters  and the covariance of the process, and this can be "inverted" to

determine the parameters from the autocorrelation function itself.

and the covariance of the process, and this can be "inverted" to

determine the parameters from the autocorrelation function itself.

Yule-Walker equations

2

2

where

is the autocovariance function of

is the autocovariance function of

is the std. dev. of the input noise process

is the std. dev. of the input noise process is the Kroenecker delta function, which is only non-zero when

is the Kroenecker delta function, which is only non-zero when

Now, if we only consider  , we can ignore the last term, and can simply

write the above in matrix form:

, we can ignore the last term, and can simply

write the above in matrix form:

My thinking

Our plan is as follows:

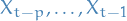

- Consider each sequence of

steps (the order of the

steps (the order of the AR) - Deduce distribution for

conditioned on the parameters of the model

and the

conditioned on the parameters of the model

and the  previous observations,

previous observations,  .

. - Obtain conditional log-likelihood function for this conditional distribution

- Get gradient of said conditional log-likelihood function

- Maximize said conditional log-likelihood wrt. parameters

- ???

- PROFIT!!!

Initial observation sequence

We start by collecting the first  observations in a the sample

observations in a the sample  ,

writing it as

,

writing it as  , which as a mean vector

, which as a mean vector  where

where

3

3

Why?

Well, we start out with the taking the expectation of  wrt. the random variables,

i.e.

wrt. the random variables,

i.e.  :

:

![\begin{equation*}

E[X_{p}] = E[c + \overset{p}{\underset{k=1}{\sum}} \varphi_i X_{p - i} + \varepsilon_{p}]

\end{equation*}](../../assets/latex/timeseries_modelling_246a72c6278eaf0be64984a15007f74899484c4e.png) 4

4

Then we start expanding:

![\begin{equation*}

\begin{split}

E[X_p] &= E[c] + E[\overset{p}{\underset{k=1}{\sum}} \varphi_i X_{p - i}] + E[\varepsilon_p] \\

&= c + \overset{p}{\underset{k=1}{\sum}} \varphi_i E[X_{p - i}] + 0, \quad E[\varepsilon_p] = 0 \\

&= c + \overset{p}{\underset{k=1}{\sum}} \varphi_i \mu \\

&= c + \mu \overset{p}{\underset{k=1}{\sum}}

\end{split}

\end{equation*}](../../assets/latex/timeseries_modelling_538f8ae1220f1082f853fd5c61fc3127bf8d641d.png) 5

5

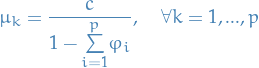

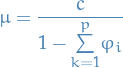

And since ![$E[X_p] = \mu$](../../assets/latex/timeseries_modelling_24e9a14e9ea05cd40ee1284326847555797b844b.png) , we rearrange to end up with:

, we rearrange to end up with:

6

6

Voilá!

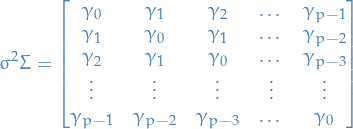

and the variance-covariance matrix is given by

7

7

where  for two different steps

for two different steps  and

and  .

This is due to the process being weak-sense stationary.

.

This is due to the process being weak-sense stationary.

The reason for the covariance matrix, is that by our assumption of weak-sense stationarity (is that a word? atleast it is now).

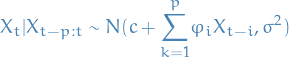

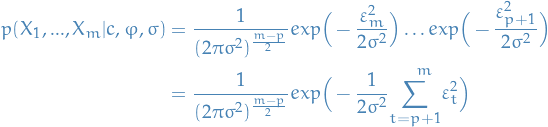

Conditional distribution

First we note the following:

8

8

is equivalent of

9

9

We then observe that if we condition  on the previous

on the previous  observations,

it is independent on everything before that. That is;

observations,

it is independent on everything before that. That is;

10

10

where  .

.

Therefore,

11

11

For notational sake, we note that we can write it in the following form:

12

12

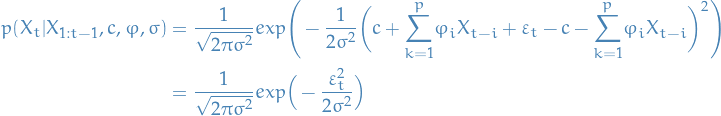

We can write the total probability of seeing the data conditioned on the parameters as follows:

13

13

Which, when we substitute in the normal distributions obtained for  ,

,

14

14

Conditional log-likelihood

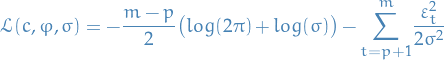

Taking the logarithm of the previous expression, we obtain the conditional log-likelihood:

15

15

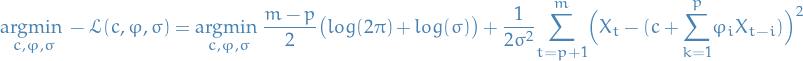

And just to remind you; what we want to do is find the parameters which maximizes the condition log-likelihood. If we frame it as a minimization problem, simply by taking then egative of the log-likelihood, we end up with the objective function:

16

16

Now, we optimize!

Optimization

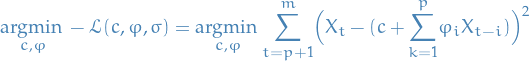

If we only consider the objective function wrt. to  and

and  , we end up with:

, we end up with:

17

17

This is what I arrived at independently, but really thought this was a huge issue because

is defined as a function of the other variables and so we have a recursive relationship!

is defined as a function of the other variables and so we have a recursive relationship!

But then I realized, after confirming that the above is in fact what you want, that the

in this equation are observed values, not random variables, duh!

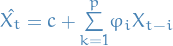

Might be easier to think about it as

in this equation are observed values, not random variables, duh!

Might be easier to think about it as  , and so we're looking at

, and so we're looking at  ,

since the last term is in fact our estimate for

,

since the last term is in fact our estimate for  .

.

Disclaimer: I think…

Thus, the conditional MLE of these parameters can be obtained from an OLS

regression of  on a constant

on a constant  and

and  of its own lagged values.

of its own lagged values.

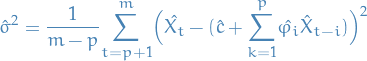

The conditional MLE estimator of  turns out to be:

turns out to be:

18

18

This can be solved with iterative methods like:

- Gauss-Newton algorithm

- Gradient Descent algorithm

Or by finding the exact solution using linear algebra, but the naive approach to this is quite expensive. There are definitively libraries which do this efficiently but nothing that I can implement myself, I think.

Moving average (MA)

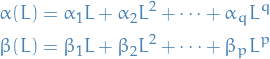

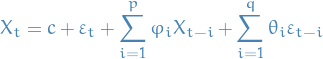

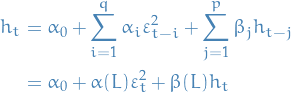

Autoregressive Moving average (ARMA)

Arma(p, q) refers to the model with  autoregressive terms and

autoregressive terms and  moving-average terms. This model contains the AR(p) and MA(q) models,

moving-average terms. This model contains the AR(p) and MA(q) models,

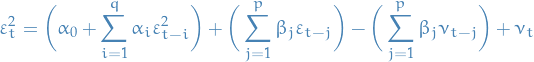

Autoregressive Conditional Heteroskedasticity (ARCH)

Notation

- Heteroskedastic refers to sub-populations of a collection of rvs. having different variablility

Stuff

- Describes variance of current error term as a function of the actual sizes of the previous time periods' error terms

- If we assume the error variance is described by an ARMA model, then we have Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model

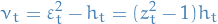

Let  denote a real-valued discrete-time stochastic process, and

denote a real-valued discrete-time stochastic process, and  and be the information set of all information up to time

and be the information set of all information up to time  , i.e.

, i.e.  .

.

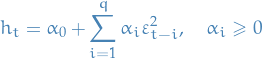

The process  is said to be a Autoregressive Conditional Heteroskedasticitic model or ARCH(q), whenever

is said to be a Autoregressive Conditional Heteroskedasticitic model or ARCH(q), whenever

![\begin{equation*}

\mathbb{E}[\varepsilon_t \mid \psi_{t - 1}] = 0 \quad \text{and} \quad \text{Var}(\varepsilon_t \mid \psi_{t - 1}) = h_t

\end{equation*}](../../assets/latex/timeseries_modelling_b666cc4f8454cf6c7ec5bd98b7781551aef6b67c.png)

with

The conditional variance can generally be expressed as

where  is a nonnegative function of its arguments and

is a nonnegative function of its arguments and  is a vector of unknown parameters.

is a vector of unknown parameters.

The above is sometimes represented as

with ![$\mathbb{E}[z_t] = 0$](../../assets/latex/timeseries_modelling_ebf30e825e3180c606b4438c6cacbe2c5c4d168a.png) and

and  , where the

, where the  are uncorrelated.

are uncorrelated.

We can estimate an ARCH(q) model using OLS.

Integrated GARCH (IGARCH)

Fractional Integrated GARCH (FIGARCH)

TODO Markov Switching Multifractal (MSM)

Useful tricks

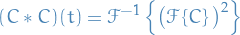

Autocorrelation using Fourier Transform

Observe that the autocorrelation for a function  can be computed as follows:

can be computed as follows:

since this is just summing over the interactions between every value  . If

. If ![$C: [0, t] \to \mathbb{R}$](../../assets/latex/timeseries_modelling_358432e8ad6c30d4208a763a5ad4646d9679582e.png) , then the above defines the autocorrelation between the series, as wanted.

, then the above defines the autocorrelation between the series, as wanted.

Now, observe that the [BROKEN LINK: No match for fuzzy expression: def:fourier-transform] has the property:

Hence,

Which means that, given a dataset, we can use the efficient Fast Fourier Transform (FFT) to compute  , square it, and then take the inverse FFT, to obtain

, square it, and then take the inverse FFT, to obtain  , i.e. the autocorrelation!

, i.e. the autocorrelation!

This is super-dope.

Appendix A: Vocabulary

- autocorrelation

- also known as serial correlation, and is the correlation of a signal with a delayed copy of itself as a function of delay. Informally, similarity between observations as a function of the time lag between them.

- wide-sense stationary

- also known as weak stationary, only require that the mean (1st moment) and autocovariance do not vary wrt. time. This is in contrast to stationary processes, where we require the joint probability to not vary wrt. time.

and

and  are lag operators such that

are lag operators such that