Bonds

Table of Contents

Definitions

Z-spread

The zero-volatility spread is a single value that needs to be added to every spot yield on the curve in order to make the present value of the risky bond equal to the present value of the risk-free bond (Treasury bond).

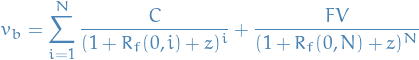

That is, if the present value of the risk bond is  , then the Z-spread

, then the Z-spread  is the value such that

is the value such that

where

denotes the coupon rate

denotes the coupon rate denotes the face-value (i.e. what we paid for the bond upon initial purchase)

denotes the face-value (i.e. what we paid for the bond upon initial purchase) denotes the spot rate of maturity

denotes the spot rate of maturity  for a risk-free bond (not annualized)

for a risk-free bond (not annualized) is the number of "periods"

is the number of "periods"

Say in the case where we had a bond for 4 yrs before it matured, which had a market price of 975:

| 1 | 2 | 3 | 4 | |

|---|---|---|---|---|

| Cash flow | 120 | 120 | 120 | 1120 |

| Treasury spot rates (risk-free) | 0.05 | 0.06 | 0.065 | 0.07 |

| Discounted Cash Flow | 114.28571 | 106.79957 | 99.341891 | 854.44264 |

| Value of bond (at maturity) | 1174.8698 | |||

| Market price | 975 |

Then the Z-spread is the value of  in the such that

in the such that  in the formula above. Hence, it's simply the "average" percentage more earnings compared to the risk-free bond.

in the formula above. Hence, it's simply the "average" percentage more earnings compared to the risk-free bond.